Self assessment accountants for directors and employees based in Portsmouth and surrounding areas

Did you file your tax return and pay your tax liability?

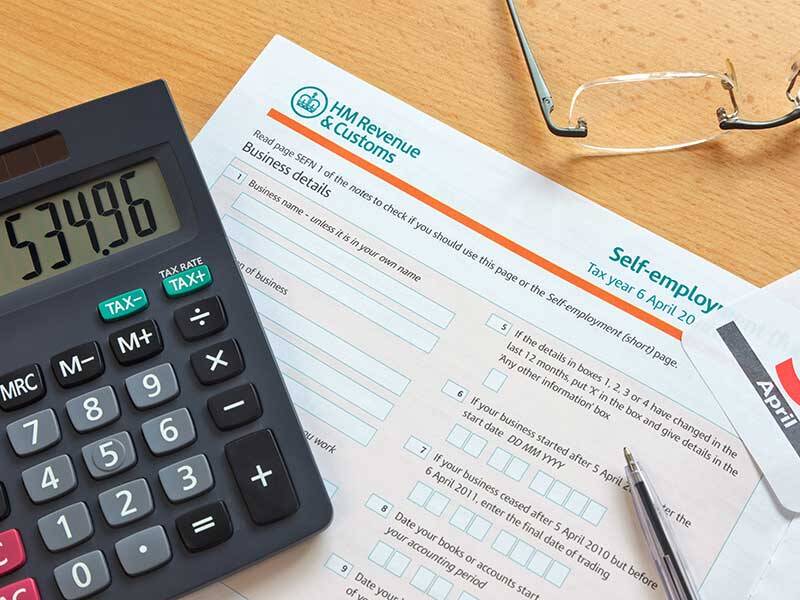

Self-assessment tax return is required for self-employed business, partners and individuals for untaxed income or claiming eligible expenses. When it is mentioned “tax return” we automatically think about a tax liability. In fact, you may be due for a tax refund that you don’t even know it!

You may be an employee, or a director would like to claim employment related expenses, may have other income like dividends, income from sale of investment, saving bank account interest income, pension income, child benefits, you may be higher rate taxpayer looking for some advice etc. There are so many areas and compliances involved with self-assessment tax return.

We totally understand, it’s difficult to assess if you need to file a self-assessment tax return and we simplify this for you with providing you self-assessment check list to assess yourself. Get in touch and request this now.

Tax, HMRC, and even self-assessment forms will take a huge amount of time, drive stress levels, cost way too much money and may even gain penalties or fines you didn’t expect. With the right accountants in place, you’ll have peace of mind.

HMRC introduced Making tax Digital for Income Tax Self-Assessment for Sole Traders and Landlords from April 2026 for qualifying income over £50,000 and from April 2027 with qualifying income of over £30,000. Intention is to help business to get their tax right and make digital records mandatory.

This means, you will need to keep your record digitally, provide quarterly return to HMRC. Early adoption is permitted.

Why not get in touch with us to book your free initial consultation and ensure your peace of mind.

Book now

This website uses both its own and third-party cookies to analyze our services and navigation on our website in order to improve its contents (analytical purposes: measure visits and sources of web traffic). The legal basis is the consent of the user, except in the case of basic cookies, which are essential to navigate this website.

This website uses both its own and third-party cookies to analyze our services and navigation on our website in order to improve its contents (analytical purposes: measure visits and sources of web traffic). The legal basis is the consent of the user, except in the case of basic cookies, which are essential to navigate this website.